February 5, 2021

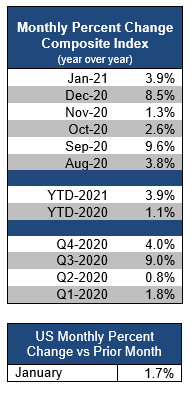

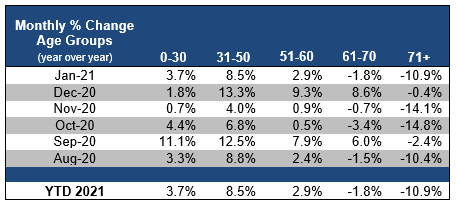

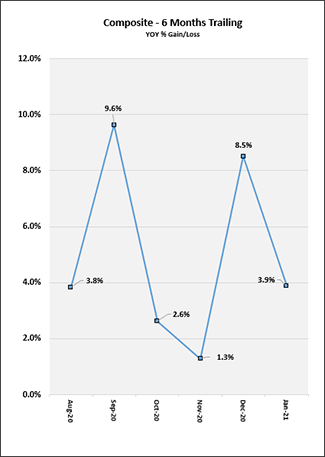

U.S. life insurance application activity continues to grow at a steady pace as we enter 2021, with YOY activity up +3.9%, according to the January MIB Life Index. Growth was largely driven by the 31-50 age group at +8.5% while older age groups age 61+ declined YOY.

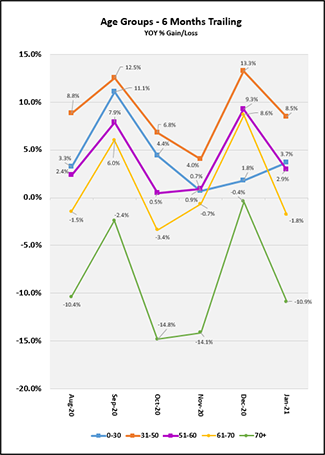

Growth in January YOY was seen across all age bands up to and including age 60. Specifically, age 31-50 lead growth at +8.5%, 0-30 grew by +3.7%, and 51-60 by +2.9%. Ages 61+ saw declines in January YOY with age 61-70 at -1.8% and age 71+ at -10.9% over January, 2020 transaction volumes.

Composite YOY growth in January was largely driven by face amounts up to and including $2.5M and over $5M. When looking at age bands, results were mixed. Activity for younger age groups ages 0-50 increased YOY across all face amounts up to and including $5M. Double digit declines were seen in face amounts over $5M for both ages 0-30 and those age 61+. Additionally, older applicants age 71+ saw double digit declines in all face amounts above $250K as compared to January, 2020.

Among those ages 0-60, YOY growth focused on Term and Universal Life products with Whole Life activity remaining relatively flat. Age 31-50 saw double-digit growth YOY of +10.2% for Term and +16.2% for Universal Life. In contrast, ages 71+ saw declines across all product types with Universal Life declines of -6.8%, Term of -4.0% and Whole Life of -3.8% YOY.

On a monthly basis, January 2021 activity was relatively flat compared to December 2020 at +1.69%. Of note, January saw increased activity over December among older age groups with ages 61-70 up 5.6% and age 71+ up 9.8% MOM.

Methodology Change for 2021:

MIB has changed the way we report trends in application activity. Effective immediately, variations with industry activity reflect a straight period over period percent changes (YTD, YOY, MOM, and QOQ) based on calendar days vs. the prior methodology based on a 2011 baseline index on a business day calculation.